Are you one of the few Omaha residents who qualify to have their tax debt reduced by up to 90%?

Find out within a 15 minutes phone consultation with our BBB A+ rated team

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Omaha, and All of Nebraska

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Our highly rated team of experts is ready to show you exactly what to do next

Highly Experienced Omaha Tax Lawyer

One of the key problems that most Omaha citizens run into in relation to IRS back taxes is feeling overwhelmed and stressed regarding the money that they owe. With the IRS taking away property, cash and assets, and even sending threatening letters and notices, revenue officers, it might be an extremely scary encounter.

We believe that no one should have to go up against the IRS alone.

It is simply not fair what they get normal tax payers through, and we consider they shouldn’t get away with it.

That’s why, for a limited time only, people who are having trouble with back tax debt in the state of Nebraska, but more especially Omaha may qualify for a free 7 Day Free Trial of all our tax relief services. That means you do not pay a penny for the full use of our seasoned team for a complete week.

30 Day Money Back Guarantee that is on top of our no questions asked. In case you aren’t satisfied for any reason with our service, just let us know within 30 days, and you will get all of your money back.

So what are you looking forward to? The longer that you wait and put it off, the more penalties and interest costs the IRS will tack on to the quantity that you owe. Take actions and call our Omaha team a call now to get started!

Give our Nebraska team a call today!

Sadly the Nebraska tax help business is full of tricks and scams, and that means you should learn the best way to avoid them.

Many people are law-abiding Omaha citizens and they fear the dangers of IRS actions. These businesses commit even and consumer fraud larceny and tempt innocent people in their scams! Therefore, caution should be exercised by you when you’re attempting to locate a tax resolution business for yourself.

What Tax Relief Scams will do

Not all Nebraska tax relief businesses who guarantee to negotiate with the IRS for you are trustworthy. Hence, avoiding IRS tax help scams is very important because there are all those fraudulent companies out there. It is possible to prevent being taken advantage of, all you need to do to follow a couple of useful hints and would be to prepare yourself in this respect! A tax resolution company that is authentic will consistently folow a mutually satisfactory financial arrangement wherein the payments could be made on a weekly, bi weekly or monthly basis.

Secondly, it is best to be quite careful when you are selecting a special tax resolution company to work with. Chances are the company is deceptive if they assure you the desired outcomes or state that you qualify for any IRS plan without even going through a complete fiscal analysis of your present situation then. After all, without going through your comprehensive fiscal analysis first, it is impossible for businesses to pass such judgment. Thus, do not fall for their sugar-coated promises and search for other authentic companies instead.

How to find out about your tax relief company

The internet is a storehouse of info, but you have to be careful about using such advice. Don’t just hire any random business with great ads or promotional efforts for handling your tax related problems. In order to select the right company, it is best to research about the same in the Better Business Bureau web site and see their ratings or reviews. Therefore, doing your homework and investing time in research is definitely a sensible move here.

A site that has a good rating on BBB is unquestionably one which you can put your trust in. We’re a BBB A+ rated Omaha business, we help people by relieving their IRS back tax debts. Our tax alternatives are reasonable, we don’t just negotiate for your benefit with the IRS, but instead develop a practical strategy to be able to ensure that all your tax debts are eliminated. Because of our vast experience and expertise in the field, you may rest assured that your tax problems would be solved effectively and promptly when you turn for help to us.

Un-Filed tax returns can add up to mean thousands in interest charges and extra fees as time passes, so act now to avoid paying more.

Have you ever forgotten to file your back tax returns for several years? We can assist.

The W-2S and 1099 forms for each tax year are needed when filing your back tax returns, you receive. In case you are eligible to credits and deductions; you will have to assemble any other supporting document which will establish your qualification to the claim.

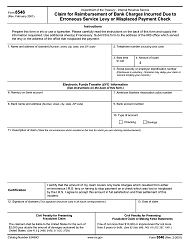

When you have any lost tax document notably within the last 10 years, then you should request a copy from IRS by simply filing form 4506-T. Form 4506-T is the tax return transcript. Nonetheless, you shouldn’t expect to get a duplicate of the initial file. IRS will provide you with a transcript including the information that you are required to file your tax returns.

Additionally, your tax returns that are back should be filed by you on the original forms for that tax year. Start by seeking the IRS site for them. After you have gathered all the relevant files, double check to ensure that you’re using the instructions associated with the same tax year you’re filling returns for. Tax laws are constantly changing and using the wrong directions may require the filing procedure to be started by you once again. Eventually, they need to submit all of the forms to the IRS through the address given.

What to Do With Un-Filed Tax Returns

For those who have any additional income tax for the previous years, you must include as much payment as you can. This fashion in which you’ll reduce interest charges accumulation. Unlike the tax fees which halt to collect once they’re at the maximum, the monthly interests continue to collect until you’ve paid the tax. They’ll send you a notice of the precise amount you need to pay as a penalty and interest rate after the IRS has received your tax returns.

You’ll need to work together with the Internal Revenue Service in case you are not able to pay your tax returns in full. Nevertheless, you should note that back taxes and the past due debts, can decrease your federal tax refund. Treasury offset program may use part or your entire federal returns to settle any outstanding national or state debt.

You should know the Department of Treasury’s of the Fiscal Service, the Agency of the Fiscal service or only BFS – runs the counterbalance program from the treasury. It might use component or your complete tax refund to pay some debts including unemployment compensation debts, student loans that are delinquent, and parent support. You may be entitled to component or the entire offset when you have filed tax returns jointly with your partner.

But should you owe any common responsibility payment, IRS can cancel the liability against tax refund due to you personally.

What You Should Do If You Haven’t Filed

You can consult with our BBB A+ rated Omaha tax law company for help for those who have not filed your back tax returns for several years.|} Our team of experts in Nebraska is always ready to help you solve your issues and in addition they are constantly ready to answer your questions.

Ultimately put a finish to the sales officers showing up at your home or company

What is a revenue official?

An IRS official or agent is a common visitor to daily life or your Nebraska business. Obtaining a distinction between the two is important that you learn how exactly to deal with each. An IRS representative has the primary function of auditing tax returns. They send notifications regarding forthcoming audits via email. You can go to local IRS office when you get an email from IRS agent or an agent comes over to your house or company to audit returns.

The IRS assigns you a revenue officer in these conditions:

Inability to Gather Tax Debts

When the IRS has failed to successfully collect taxes from you using the ordinary channels like notices, levies, telephone calls and emails.

Un-Filed Taxes

Like payroll taxes when you don’t pay certain form of taxes.<?p>

Huge Tax Debts

A standard amount being 25,000 dollars or more. when your tax liability is substantially large

Recall IRS revenue officers are mandated by law to undertake measures to regain the taxes. These measures repossess property, freeze assets or wage garnishments, seize and may include issue levies. Expect these policemen to show up at your home or area of businesses sudden or without previous communication. In infrequent cases, you might be called by the officers or send you emails summoning you to their offices. Try to work with them to prevent further complicating your case and attempt to pay you delinquent taxes to the extend your income can accommodate. If your case is more complicated or the tax sum requires you to work out a plan to pay, you’ll need the professional services of an attorney.

What You Should Do if you Get {a Revenue Official|an IRS Revenue Official

If you are not able to pay off your debt instantaneously, the Internal Revenue Service official might request financial records and some files. Filling these forms should be done right and precisely thus the professional services of an attorney are needed. So, as soon as you get these forms, the very first thing to do is to call a lawyer.

Also, an attorney in Omaha will review your financial situation and work out the best paying strategy with all the IRS revenue officials. Without an attorney, the IRS policemen might intimidate you into consenting to a plan that you cannot afford but which makes their job easier. If you are given tight datelines, an attorney can easily negotiate and get you a more flexible one. Remember, there are many choices that can be offered by the officer. A standard one in case related to payroll overdue would be to assess and assign you a retrieval fee trust fund. For this to occur, an interview should be run to ascertain who is the real culprit between a business and also a person and having an attorney during this interview in Nebraska is a matter of necessity.

If your Omaha company has run into tax or payroll problems with the government, we can help.

The IRS is a formidable collection machine for the Federal Government, and they are going to collect, in case your business has dropped into IRS or Nebraska company tax debt. Thus, if your company has delinquent taxes like payroll tax debts there isn’t any need to scurry for cover (and remember – never conceal) even in case you know little or nothing about dealing with IRS company tax debts. There are experienced professionals ready to help.

Un-Filed Payroll Tax Debts

The Internal Revenue Service looks at payroll tax – taxes levied on workers and employers – from two viewpoints:

- (a) Taxes a company pays the IRS predicated on the wages paid to the worker (known as withholding tax’ and is paid out of the companies own funds) and

- (b) A portion of wages the employer deducts from an employee’s wages and pays it to the Internal Revenue Service.

Repayment Timeline

Employment or Payroll taxes are collected by the IRS through the Electronic Federal Tax Payment System (EFTPS). The schedule of these payments depends on the typical amount being deposited (based on the look back period’ – a twelve month period ending June 30). This payment program may be monthly or semi-weekly.

In case you are a company that is new and didn’t have some employees during your look back period’ or in case your entire tax liability is up to USD 50,000 for your appearance back period’, you must follow a monthly schedule. Your payroll taxes should be deposited by the 15th of the month following the last payday.

In case your payroll tax liability is less than USD 50,000 you will have to follow a semi-weekly deposit program. These taxes should be deposited by Sunday, Monday, Tuesday or Wednesday following the Friday payday. You will fall into a payroll tax debt, if you don’t pay your taxes on these days. You ought to seek the professional services of tax professionals to guide you through this maze of processes and keep from falling into payroll tax debt and avoid hefty fees.

How To Deal With Back Tax Debts

Revenue collected through taxes for example payroll tax are spent on financing plans like; healthcare, social security, worker’s compensation, unemployment compensation and at times to improve local transfer that carries many workers to and from work.

When you need to take care of IRS tax debts, it truly is extreme important to keep in touch with your IRS officials – never prevent or conceal from them. Most IRS penalties contain a compounded interest rate of 14% this can turn a business turtle in an exceedingly short time, so dealing with IRS business tax debt it predominant.

How a Professional Omaha Tax Expert Can Help You

Being in an IRS company debt situation is serious. You might have time on your own side when they gain impetus things get worse for you, although as the IRS is slow to begin processing your account. Yet, you aren’t helpless. There are processes you may be qualified for that a Nebraska professional can use his good offices with the IRS to help you over come your business debts.

Amongst others, you need a professional’s help, if you never have learned of an Offer in Compromise, Tax Lien Span, Uncollectible Status and Insolvency. Waste no more time, get in touch with us today to get out of business tax debt and save your company from closure.

If you have had a bank levy put on accounts or your property, let our Nebraska team remove it for you within two days.

Bank levies are charges imposed on your Omaha bank account when you’ve got outstanding tax debt. The law permits the Internal Revenue Service to seize funds in your bank account for clearing your tax obligations. Regrettably, the process isn’t consistently smooth. Usually, the association ends up freezing all the cash that’s available in a specified account for a period of 21 days to deal with a man’s or a company’ tax obligation. During the freeze, you can’t get your money. The sole possibility of getting them at this stage is when they are unfrozen when the interval lapses. Preventing the levy allows you to get your resources for fulfilling with other expenses.

When and Why Levies Get Slapped On

The Internal Revenue Service bank levies are applied to your account as a last resort for you to pay taxes. It occurs to those in Nebraska who receive many evaluations and demands of the taxes they owe the revenue bureau. The IRS is left by failure to act within the legal duration of a tax obligation with no choice other than to proceed for your bank account. This happens through communication between the IRS and your bank. If you’re not aware, you’ll find that on a certain day. For thinking to levy along with a notification about your legal right to a hearing, a closing notice is followed by bank levies. In short, the IRS notifies you of the pending bank levies. The IRS can just require cash that was on the date a levy is applied in your bank when used.

How to Get a Bank Levy Removed in Omaha

There is a window of opportunity for you to use to get rid from your account of bank levies. As you take measures to safeguard your bank assets, getting professional help is a wise move that you simply ought to take. With a professional service it will not be difficult that you know when to take your cash out of the bank. Before the bank levy happens besides removing your funds, you also have to enter into a payment arrangement with all the Internal Revenue Service to prevent future bank levies. You can certainly do this by getting into an installment agreement. Finally, you can go for ‘offer in compromise’ as a method to get tax forgiveness.

They can be extremely complex to implement, while the solution sound simple. Have the resources to do so you need to act fast, comprehend every aspect of the law and deal with associated bureaucracies imposed by banks as well as the IRS. The smart move would be to call us for professional help with your IRS scenario. We have skills and experience which have made us a number one pick for a lot of people. For help and additional information, contact us for partnered tax professional support.

Other Cities Around Omaha We Serve

| Address | Omaha Instant Tax Attorney1823 Harney St, Omaha, NE 68102 |

|---|---|

| Phone | (402) 316-1711 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Omaha We Serve | Alvo, Ames, Arlington, Ashland, Avoca, Bellevue, Bennington, Blair, Boys Town, Cedar Bluffs, Cedar Creek, Ceresco, Colon, Craig, Davey, Dunbar, Eagle, Elkhorn, Elmwood, Fort Calhoun, Fremont, Greenwood, Gretna, Herman, Hooper, Ithaca, Kennard, La Vista, Leshara, Lincoln, Lorton, Louisville, Malmo, Manley, Mead, Memphis, Morse Bluff, Murdock, Murray, Nebraska City, Nehawka, Nickerson, North Bend, Oakland, Offutt A F B, Omaha, Otoe, Palmyra, Papillion, Plattsmouth, Prague, Raymond, Richfield, Scribner, South Bend, Springfield, St Columbans, Syracuse, Tekamah, Uehling, Unadilla, Union, Valley, Valparaiso, Wahoo, Walton, Washington, Waterloo, Waverly, Weeping Water, Weston, Winslow, Yutan |

| City Website | Omaha Website |

| Wikipedia | Omaha Wikipedia Page |